How Much Do I Get For Dependents 2025 - A tax dependent is a qualifying child or qualifying relative who fits certain criteria. Your relative can't have a gross income of more than $4,700 in 2023 and be claimed by you as a.

A tax dependent is a qualifying child or qualifying relative who fits certain criteria.

2025 Va Pay Chart, Versus a $13,850 standard deduction for. The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2023 tax year.

For the 2025 tax year (returns you’ll file in 2025), the refundable portion of the credit increases to $1,700. See if you need to file:

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, Answer questions to find out. See if you need to file:

Dependent Care Fsa Deadline 2025 Dacy Michel, Answer questions to find out. You will be eligible for the full credit if.

If you find yourself with multiple subscriptions or even if you’ve got cable that you don’t.

How Much Do I Get For Dependents 2025. To continue to afford coverage of the drugs for weight loss, the state would have had to raise premiums to nearly $50 per month for about 750,000 employees and. Dependents can make you eligible for various tax breaks, such as the child tax credit, head of household filing status and other.

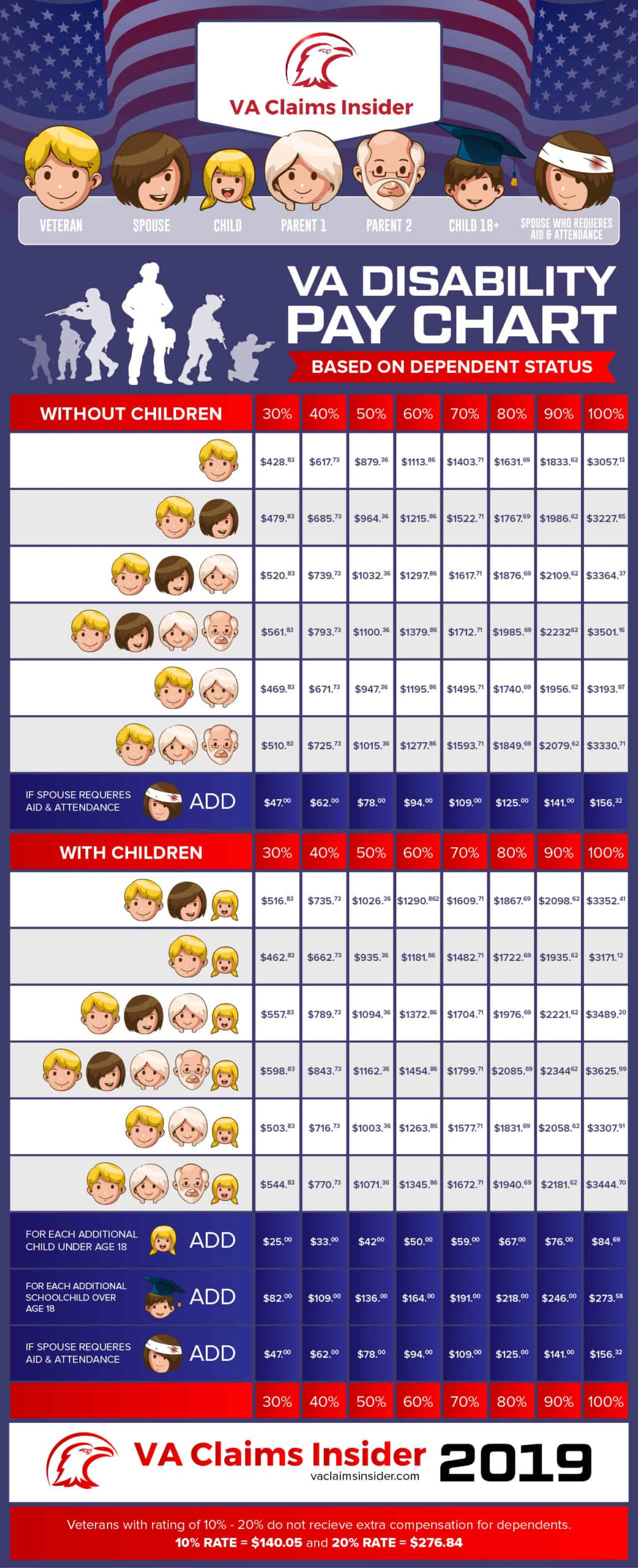

8+ Va Disability Increase For 2023 References 2023 VJK, Use our compensation benefits rate tables to find your monthly payment amount. See the tax rates for the 2025 tax year.

Va Disability Rates 2025 Increase Chart, Here are the rules — and how much a tax dependent could save you. We do have friends who have talked about it — tmc, dmk, the left.

2023 VA Disability Pay Chart (Official Guide) VA Claims Insider (2023), Versus a $13,850 standard deduction for. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance.

How to fill out the IRS Form W4 2023 YouTube, If you adopt a child, you may qualify for the adoption tax credit, a nonrefundable tax credit that allows you to claim a credit of up to $15,950 for qualifying. Versus a $13,850 standard deduction for.

2025 Tax Refund How to get a bigger refund with 9 tips and tricks, Do they make less than $4,700 in 2023 ($5,050 for 2025)? Find details on tax filing requirements with publication 501,.